What Is A Vendor Account & How To Produce One L Square

With today's selection of settlement options, a company owner generally needs both a service examining account as well as a merchant account. Understanding the difference and also objective of each will certainly help you effectively serve your clients. The even more options your clients need to pay you, the more probable they are to be repeat buyers.

Do you need good credit to open a merchant account?

Though name on card meaning you don't need a high credit score to open a business bank account, poor credit history and a track record of negative banking activity could limit your options. If you're concerned about being turned down for a business bank account, shop around for a bank or credit union that doesn't use ChexSystems.

Payment portals may just deal with some merchant accounts and types of financial institutions. This might not benefit all clients, and also therefore, you may intend to represent an additional type of settlement. For an on-line company, it will instead provide the software program to use. It will establish a digital terminal on the site for repayment processing in online sales.

Approve Repayments Online, In

Approve and process debit cards, credit cards, as well as various other electronic repayments. Instead, your seller account service provider will immediately move these funds from your seller account to your savings account when the purchases have totally removed. This process usually takes 3-5 business days, although numerous suppliers currently provide next-day-- or even same-day-- financing.

- The cost uses whether or not the request is approved.

- That's where collaborating with a settlement entrance like PayPal is available in.

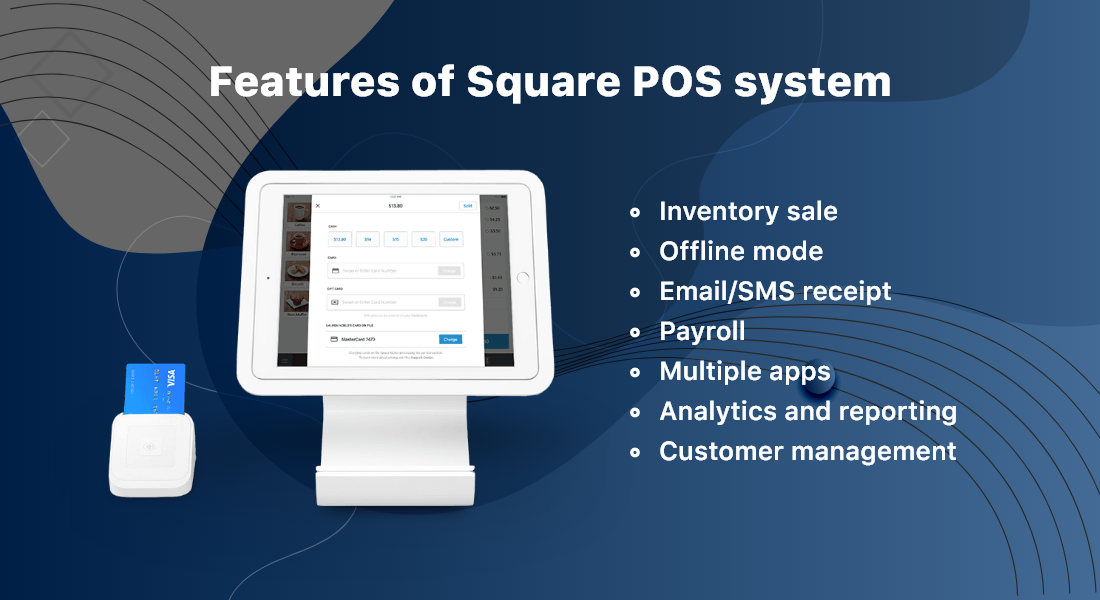

- Square's customer management software program additionally makes it square vs clover feasible for a small company proprietor to release a loyalty program.

- A seller account enables small-business owners to accept debt as well as debit card settlements.

Once funds get to the vendor account, they generally transfer to business account. Allow's break down the difference between a repayment portal vs a merchant account. Although having 2 savings account appears bothersome, you shouldn't use an individual account for your organization finances mostly due to the gentlemans clubs fact that it can impact your legal responsibility. An act in between a seller as well as a cardholder that causes either a paper or a digital representation of the cardholder's debenture for goods or services obtained from the act.

Totally Free 1st Month Of Processing

But also for large volume organizations, this strategy can conserve cash. Card turn over is the quantity of cash you expect to take on debit as well as credit cards. This might affect the rates that you will certainly pay with your vendor account provider. Keep in mind that processors may request more details if your business has accepted charge card or various other repayment types in the past, including current seller statements. This is because the cpu requires to review the risk posed by your service.

Why a Social Security number is required for a merchant account?

In summary, all US processing banks require a SSN in order to approve any merchant account; to confirm the identity of the signer, to determine the credit worthiness of the signer, and to provide an effective personal guaranty.

The biggest takeaway is that they're not the exact same point. Your company will certainly need both to process payments from clients securely. The settlement entrance "talks" to the seller, cardholder, and both sending out and also obtaining bank to process the purchase.