The Distinction In Between A Vendor Account And Also Business Bank Account

Blended rates uses a tailor-maked price for business owner, based on a number of different elements such as the sort of cards being made use of. Set up by the Settlement Card Sector Data Safety And Security Criterion, PCI conformity shields your customers from fraud. If you are not certified or can't reveal you are, your vendor acquirer can fine you with added fees. For example, if a card owner is absent when you make the repayment over the phone you'll be billed a higher cost. One of the most preferred cards utilized internationally are Visa and Mastercard, but you might intend to permit your consumers to make use of American Express, Discover or Diners, which will come at a tiny extra cost. Prior to you open a seller account, you'll require to understand some crucial details regarding your business so you get the most suitable option.

Citi Merchant Offers: Everything You Need To Know - Forbes

Citi Merchant Offers: Everything You Need To Know.

Posted: Tue, 19 Jul 2022 07:00:00 GMT [source]

As soon as the procedure is complete, the funds will usually be launched to a company bank account. Among the most effective means to clover station pro price see to it you distinguish between individual and also overhead is by using a separate organization bank card. Expenditure coverage can be a complicated, yet vital job for local business, and also charge card statements can be a valuable asset when monitoring organization spending. Besides internal revenue service bookkeeping issues, making use of a business account additionally adds a note of professionalism and reliability to your business. If a client obtains a personal check for services rendered, they might not take you as seriously as you would certainly such as.

Exactly How Do I Open Up A Merchant Account?

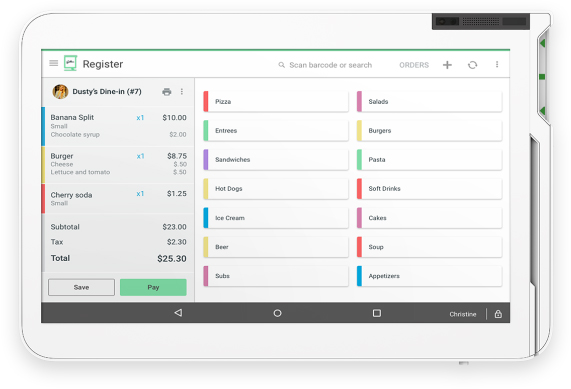

You can think of your vendor account service like a holding pen for your money once it's been processed by the bank. In physical shops, a payment handling solution offers the vendor whatever it requires. This will consist of supplying a bank card terminal for taking in-person repayments. If your organization is brand-new and/or you're unclear of its growth trajectory, it's ideal to avoid startup prices as well as long-lasting agreements. Settlement provider usually have month-to-month options without configuration fees.

What is the type of merchant?

There are basically two types of merchants – wholesale and retail. Apart from these, newer types of merchants known as the ecommerce merchants have also emerged and earned a place in this digital age.

Account is if you do not prepare to accept debit and bank card or electronic settlements at any time. If you are strictly cash and also check service, you can go on with a business checking account. One more huge difference in between a merchant account and also an organization bank account is that your merchant account is essentially fronting you the money whenever your consumers pay with a card. It's a bit challenging, but all of it has to do with how the money takes a trip behind the scenes.

Treasury & Settlement Solutions

Funding speeds will certainly vary between weekdays and also weekends and depend on batch times. Funding is based upon batch as well as will be refined everyday, including weekend breaks. Activation might take in between three to five service Visit this link days from date of Everyday Funding service request. When the file is activated, there will be a change in the summary of the settlement when it is uploaded to your savings account. If a merchant comes across a chargeback they might be assessed a charge by their acquiring financial institution.

- Right here's why greater than 70,000 small business proprietors like you utilize Paymentsense.

- Since a specialized seller account calls for a substantial application process, the carrier will certainly be much more acquainted with your business.

- The very early discontinuation cost can be billed by some service providers if the merchant ends the agreement prior to completion of the contract term.

- A payment processor's underwriting department will certainly intend to explore your service prior to authorizing your application for a seller account.

Rather, they depend on banks, Independent Sales Organizations, monetary service providers and independent agents to provide the accounts. American Express is different from the various other 3 due to the fact that it offers its own seller accounts directly and also does not make use of any type of third-party sales companies. If you desire to accept American Express Cards, you should set up a different American Express vendor account. Discover Card acceptance can be set up with a VISA and MasterCard provider. Despite all this, the various card kinds can be negotiated through the exact same payment devices and also payment entrances.

Take Repayments Personally, Online Or By Phone

Red stripe started out as a tool to make it easy for designers to approve bank card settlements in their apps. Due to the fact that there have constantly been several hoops to jump through typical financial, approving credit card repayments was a major obstacle for a great deal of early-stage start-ups. That relies on the settlement processor you select as well as the terms of your seller agreement. To obtain a committed seller account for your business, you'll require a seller service contract.

Right here are https://writeablog.net/legonaetfy/we-believe-that-payment-handling-for-high-risk-merchants-is-usually-ignored-or several choices offered for establishing normal repayments to yourself. It might feel like an unnecessary action, yet dividing your bank accounts can shield you in even more means than one. It is just among the several manner ins which NMA functions to keep more profit in your pocket. Automated Cleaning Home is a digital settlement Network that exchanges funds via Electronic Funds Transfer throughout the U.S.

U.S. Bank Promotions of August 2022: $400 Bonus Offer – Forbes Advisor - Forbes

U.S. Bank Promotions of August 2022: $400 Bonus Offer – Forbes Advisor.

Posted: Tue, 02 Aug 2022 19:57:00 GMT [source]

As your consumers submit debt and debit card repayments, the funds from each purchase are conserved in your seller account. You can after that take the total funds and also transfer them to your major business savings account at your leisure. Funding times are usually 1 to 2 days as long as you work with a reliable committed merchant. Be sure to inquire about financial institution transfer times when contrasting providers.

Can an individual get a merchant account?

You need a business bank account.

You can open one in about 15 minutes at your local branch and they only require that you have a business license and EIN (employer identification number, which can be your social security number if you're a sole prop with zero employees). You can also apply for an EIN through the IRS.